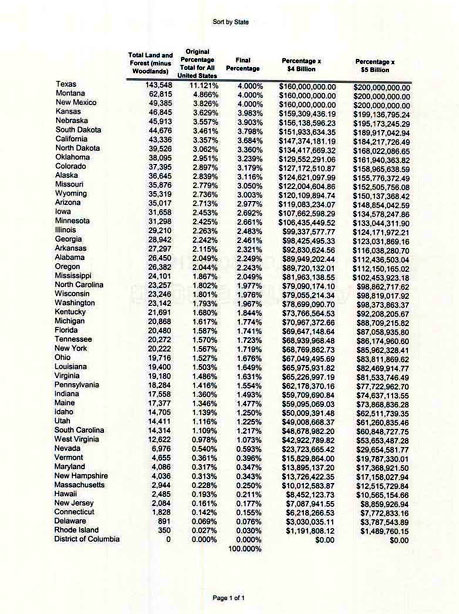

STATE BY STATE ANNUAL ALLOCATION OF CREDITS

The original formula contemplated for S.2187 provided that a State's portion of the total amount of tax credits would be calculated by multiplying the aggregate annual tax credit ("Annual Credit") by a fraction which is equal to the following: working from the U.S. Department of Agriculture's 1997 land use census ("Agriculture Census"), the denominator shall be the total acreage of "land in farms" in the United States and the numerator shall be the total acreage of "land in farms" in the particular State. Notwithstanding this formula, no State would receive more than 4% of the Annual Credit.

Research and study over the last twenty months have led to the conclusion that

the Annual Credit should total $25 billion over five years, with the Annual

Credit being $4 billion in the first year and then increasing by $500

million each year, with the Annual Credit for the fifth year then being

$6 billion. Likewise, it was determined that a more appropriate allocation

formula to use would be based on the Agricultural Census as well as the

1997 U.S. Forest Service census ("Forest Census"). Using data from these

two reports, a State's annual allocation would be determined by multiplying

the Annual Credit by a fraction which would be equal to the following:

the denominator shall be the total acreage in the United States in "land

in farms" less "total woodland" under the Agricultural Census plus the

total amount of "private forest land" under the Forest Census and the

numerator shall be the total acreage for the particular State in "land

in farms" less "total woodland" under the Agricultural Census plus the

"private forest land" under the Forest Census. Notwithstanding this allocation,

no State would receive more than 4% of the Annual Credit. Allocations

under this revised recommended formula for Annual Credits of $5 billion,

by way of example, are attached.

Exhibit "A"